Comprehensive Value Investing Platform

Accurate and automated valuation for all stocks globally. Save countless hours scanning through stocks and building DCFs yourself.

Check out our DCFsAccurate intrinsic value

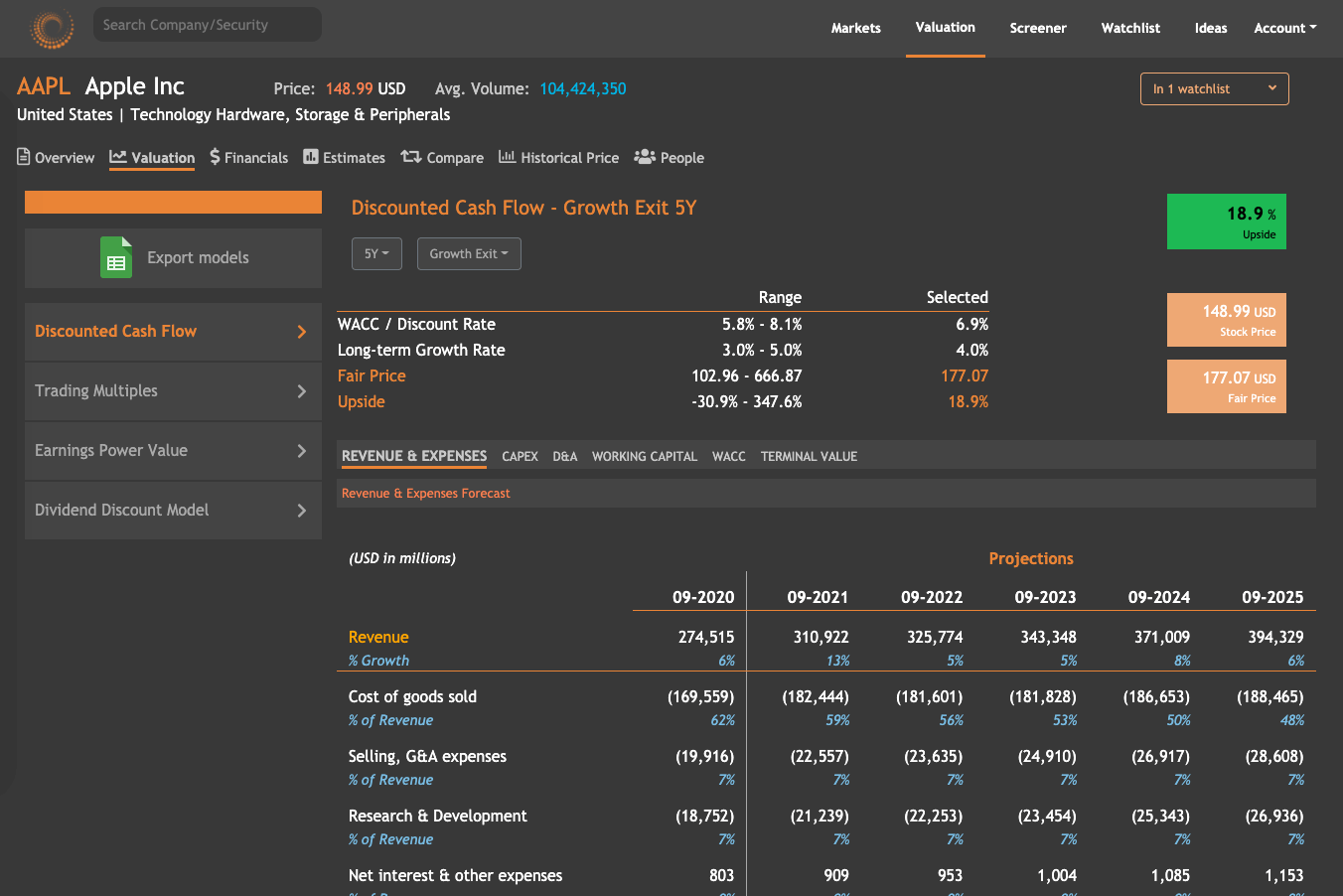

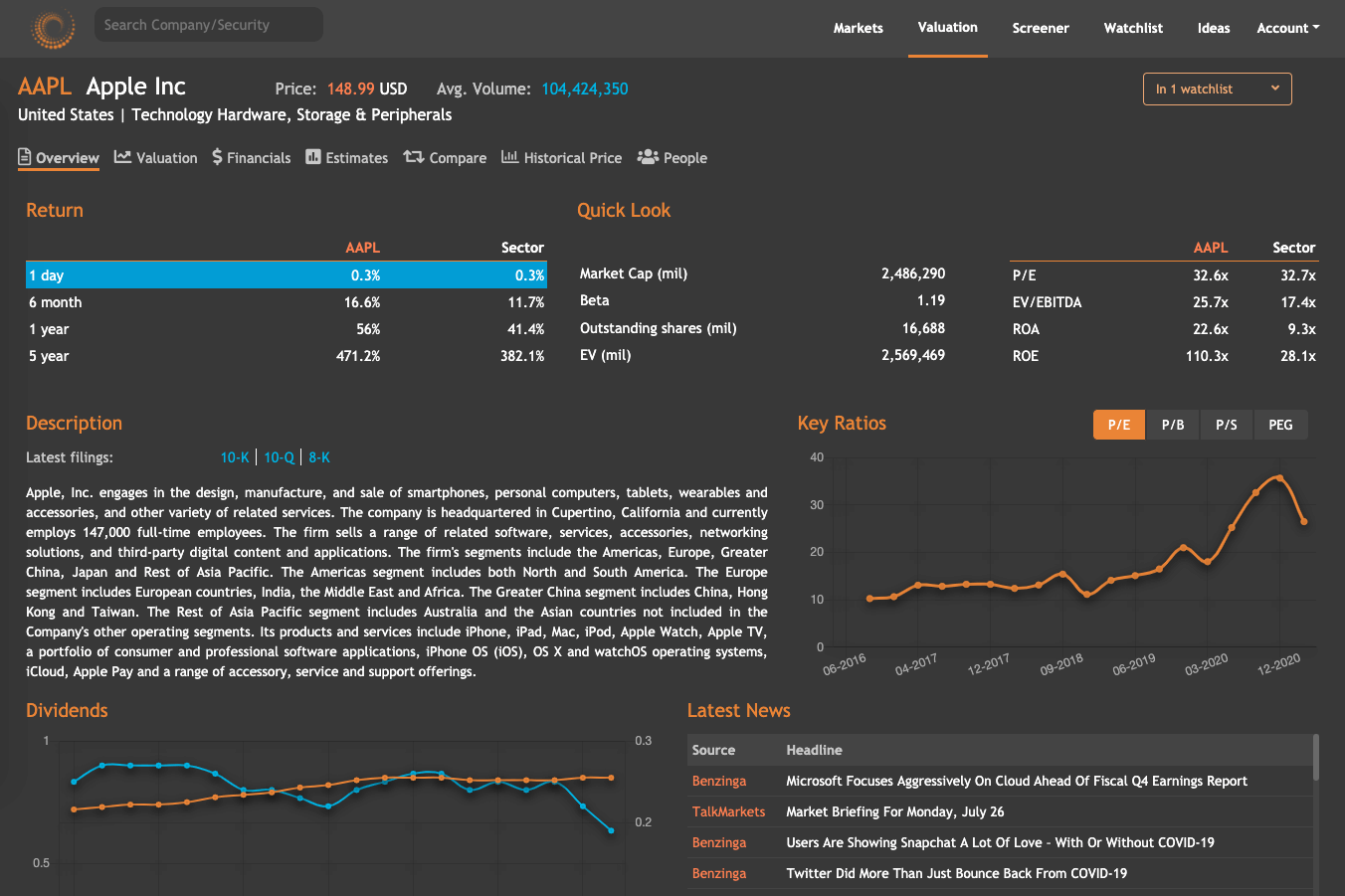

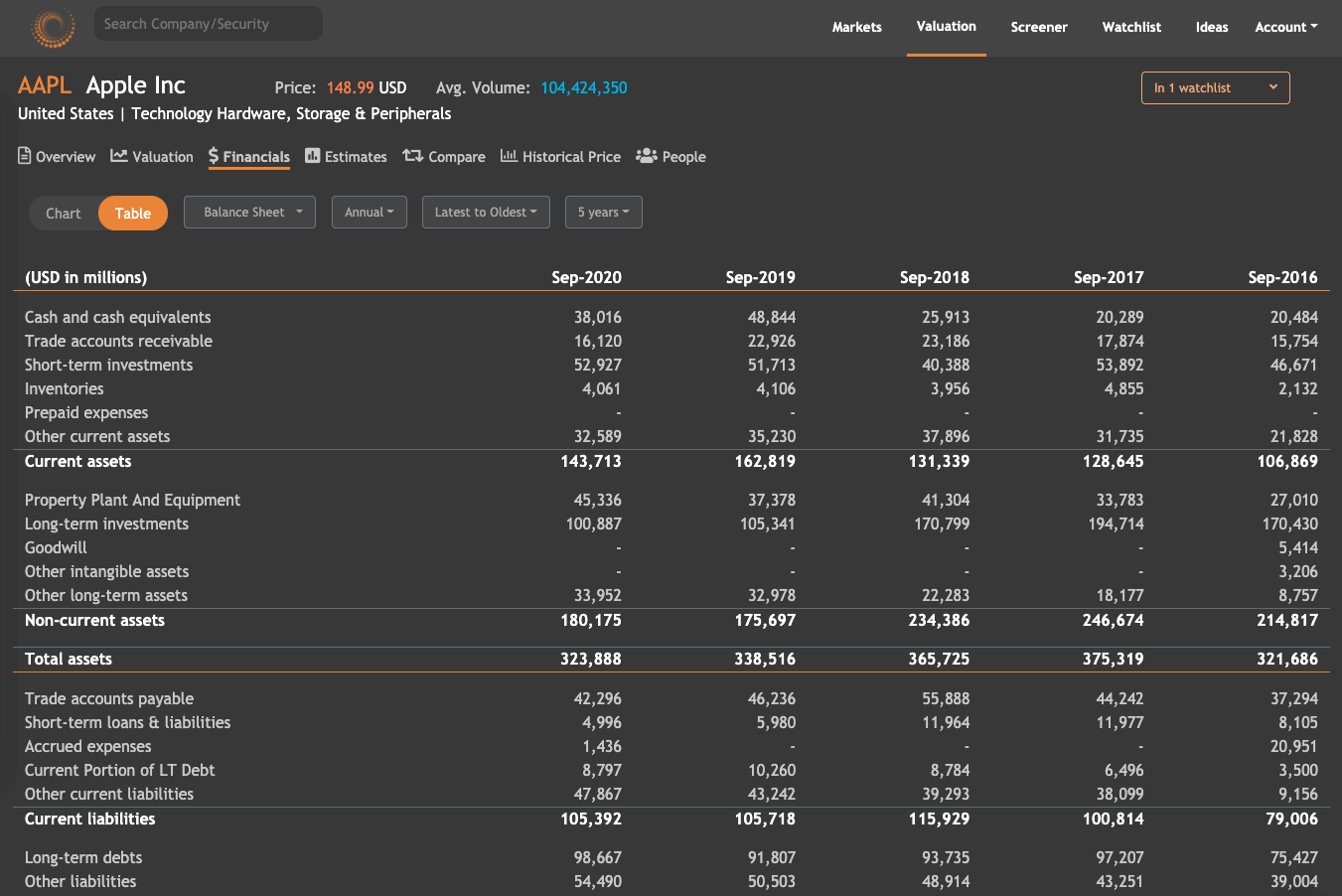

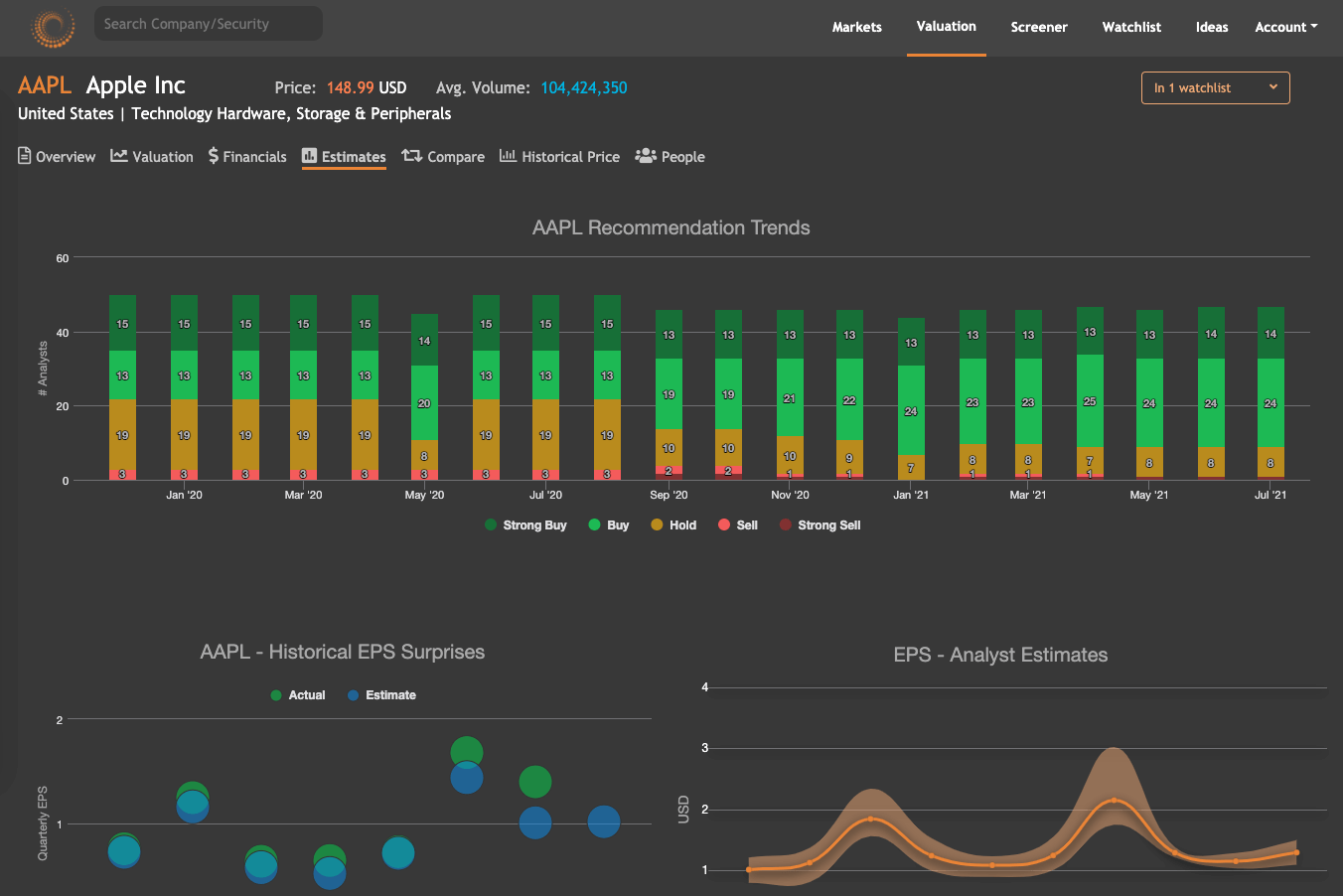

Automated Discounted Cash Flow using only public historical+macro data, Prof. Damodaran's estimates and unbiased consensus forecasts.

Global coverage

Up-to-date and accurate financial data for over 45,000 stocks on 60 major exchanges globally with unlimited data export capability.

Powerful stock screener

Find the most undervalued/overvalued stocks with our world-class screener that supports hundreds of metrics.

AI-powered SEC Search

Search information on listed companies globally from within millions of research and filing documents in seconds

A research-based valuation platform

We incorporate all publicly available and unbiased company data into our DCF. Therefore, our valuation is as close as it gets to the intrinsic value of a stock. Nonetheless, you have full visibility to the assumptions and can modify them based on your preference.

These prices are for Personal use only and have not included 10% taxes. Contact us for Enterprise pricing. If you are a student/educator, email us for 50% - 100% discounts.

Free Plan

FREE

- Full access to

5 stockseach month

- Export data for 3 stocks each month

- S&P 500 only in screener and watchlist

- Limited screener/watchlist metrics

- T

- T

- a

Regional Plan

$14.99

- Full access to all stocks in

1 region

- Unlimited data export to Excel/Sheets

- Unlimited screener and watchlist

- Advanced Charting

- Guru Portfolios

- Earnings Calendar

- Additional regions can be added

Global Plan

$42.99

- Full access to

all stocks globally

- Everything in Regional Plan

- AI-powered Filings Search tool

- API access. Read docs

- Global ETFs and Mutual Funds

- Economic Calendar

- a

What is Value Investing?

Value investing is an investment paradigm that involves investing in stocks that are overlooked by the market and are being traded below their true worth. A stock's true worth is its intrinsic value, which is commonly calculated using a DCF valuation model.

At ValueInvesting.io, we fully automate the process of obtaining the intrinsic value for all stocks globally, and offer investors institutional-quality resources that were once only available to Wall Street professionals:

- State-of-the-art valuation models

- AI-powered Filings Search

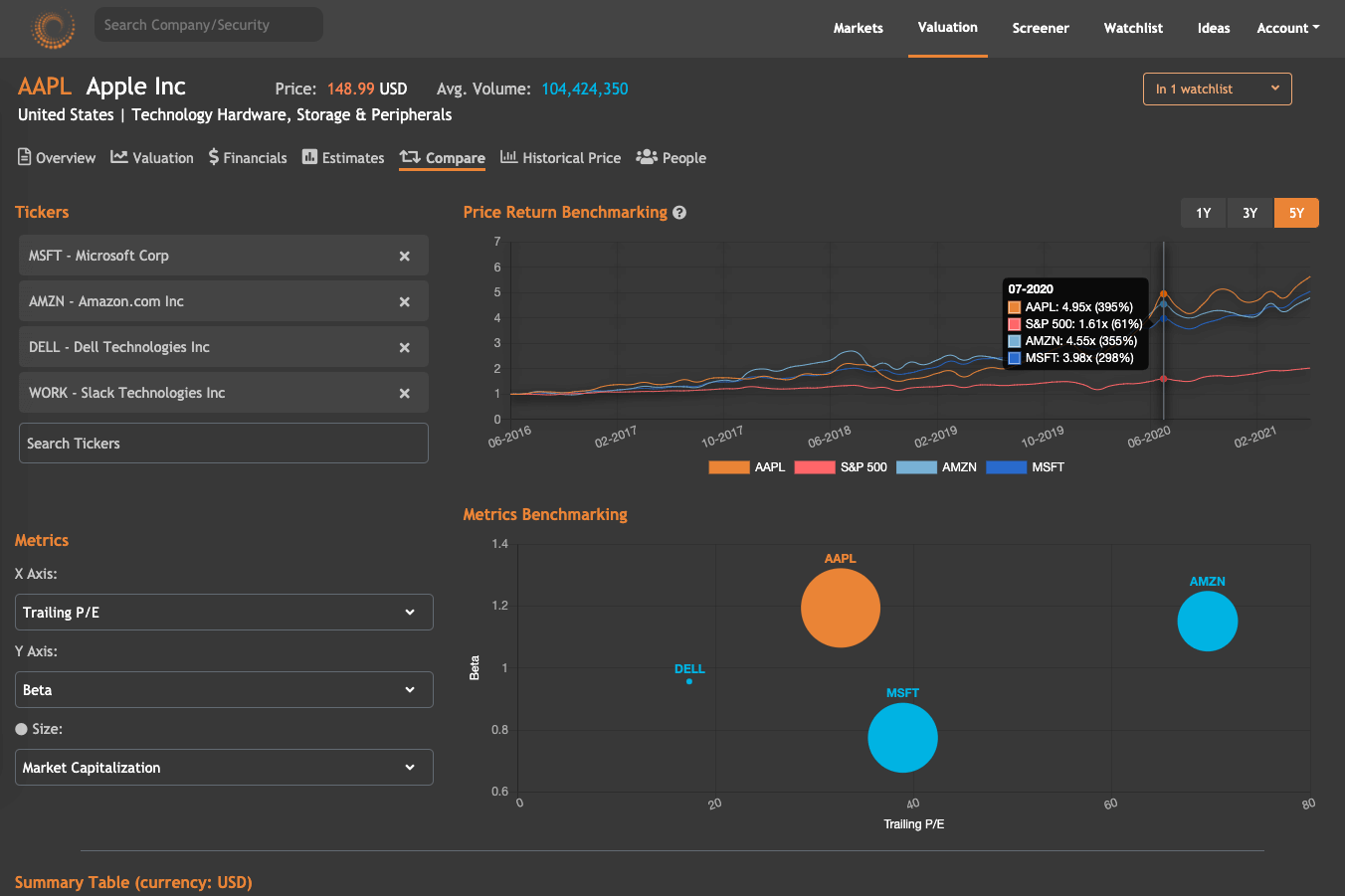

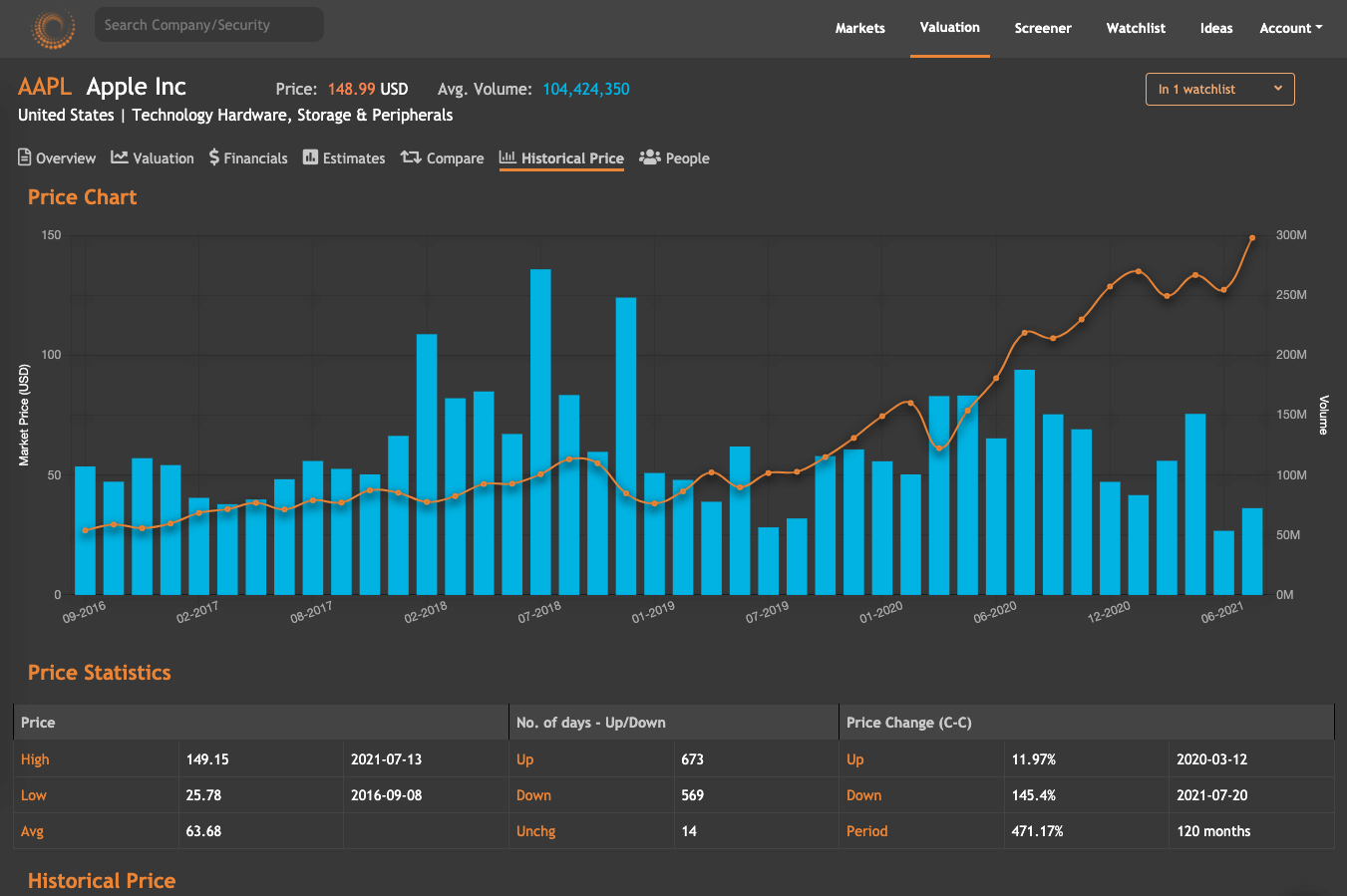

- Advanced Charting

- Unlimited export to Excel/Sheets

- Institutional-grade data

- World-class screener & watchlist