Portfolio Visualizer

Complete toolkit to help you visualize, analyze, backtest and optimize your portfolios and investment strategies.

Start BacktestingBacktest Portfolio »

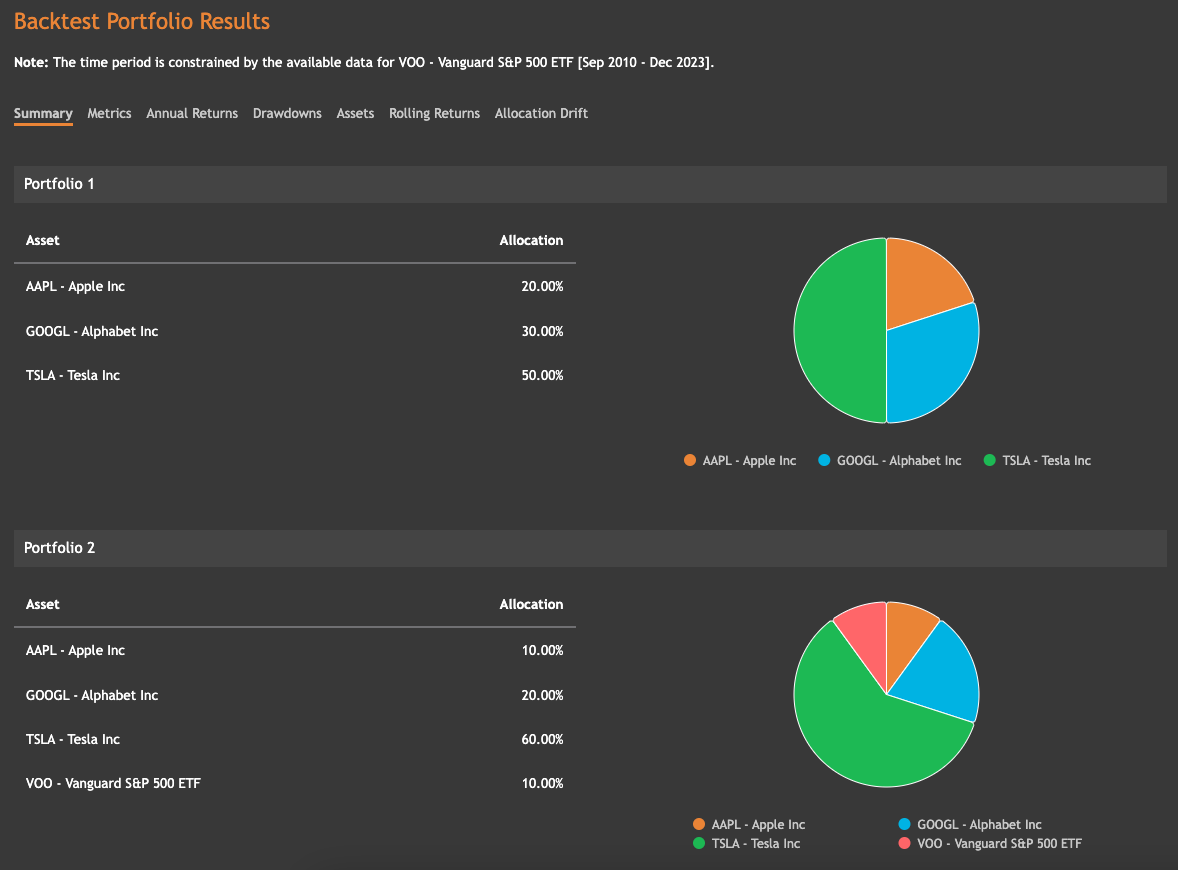

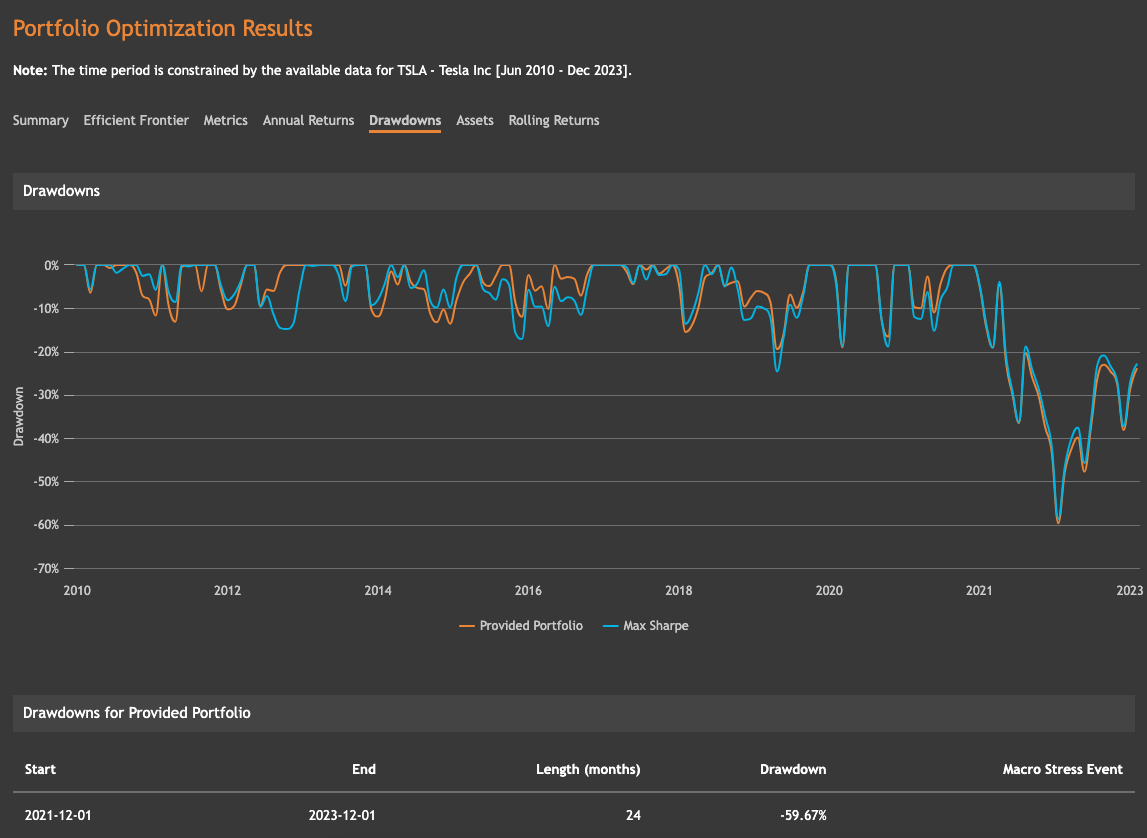

Backtest your portfolio using historical data to understand its survival, risks and returns.

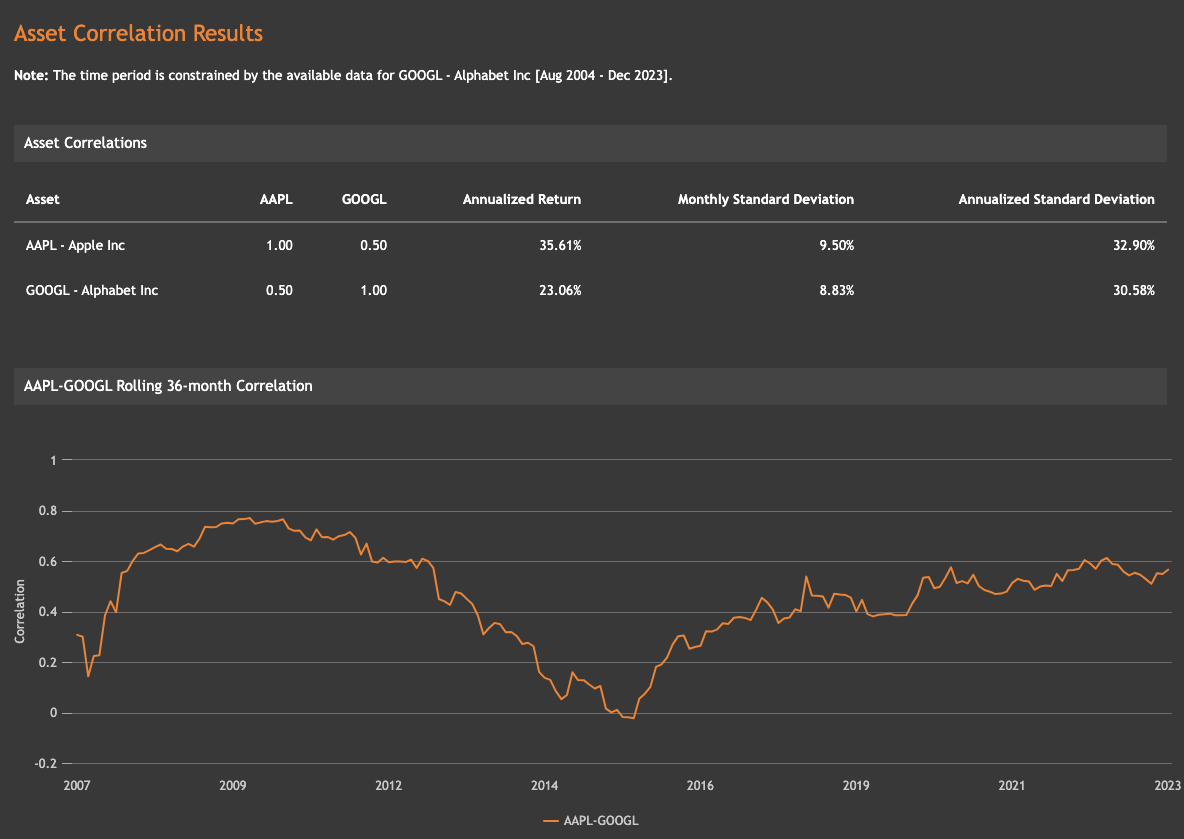

Asset Correlations »

Compute correlations and rolling correlations for multiple assets using their historical price data over a given time period

Portfolio Optimization »

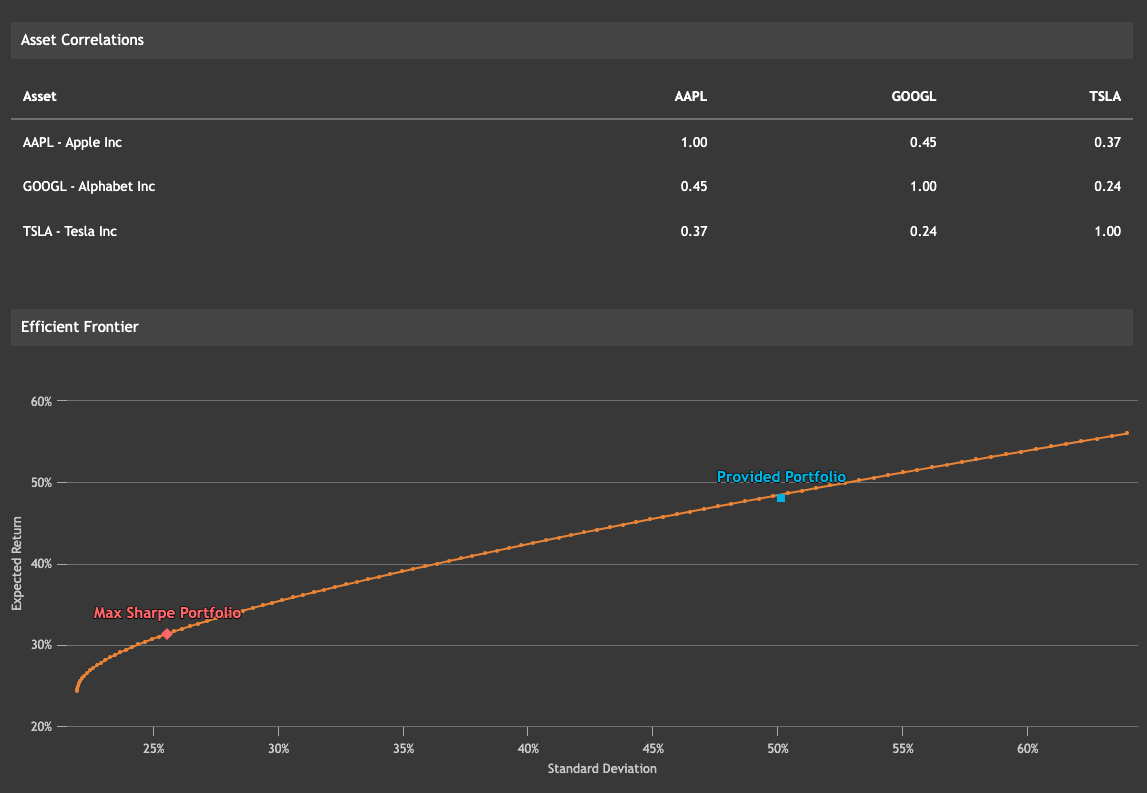

Selects the best allocations for a given list of assets using one of 4 optimization goals: Mean Variance, CVAR, Risk Parity and CDAR.

Efficient Frontier »

Plot the efficient frontier of a given portfolio to visualize optimal weight allocations in terms of risk-return tradeoff.

Complete toolkit for portfolio analysis